Wednesday, December 09, 2009

Calculating National Insurance

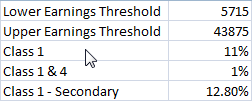

Create the cells above and create names for each of the values from the names in the left column.

Two functions are available, one for employee national insurance, one for employer.

The calls are

=NationalInsurance(50000.0,Lower_Earnings_Threshold,Upper_Earnings_Threshold,Class_1,Class_1___4)

=EmployerNationalInsurance(50000.0,Lower_Earnings_Threshold,Class_1___Secondary)

The code for these functions is this

Function NationalInsurance( _

income As Double, _

lowerearnings As Double, _

upperearnings As Double, _

classonerate As Double, _

secondaryrate As Double _

) As Double

NationalInsurance = 0#

If income <= lowerearnings Then

Exit Function

End If

If income <= upperearnings Then

NationalInsurance = (income - lowerearnings) * classonerate

Else

NationalInsurance = (upperearnings - lowerearnings) * classonerate + (income - upperearnings) * secondaryrate

End If

End Function

Function EmployerNationalInsurance( _

income As Double, _

lowerearnings As Double, _

secondaryrate As Double _

) As Double

EmployerNationalInsurance = 0#

If income <= lowerearnings Then

Exit Function

End If

EmployerNationalInsurance = (income - lowerearnings) * secondaryrate

End Function

Calculating UK Tax

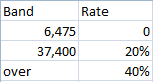

With this as a table, the following function call can be made from Excel

=IncomeTax(50000.0,TaxRates)

To calculate the tax paid. TaxRates is the range above.

The code for this is as follows.

Function IncomeTax(income As Double, rates As Range) As Double

Dim i As Integer

Dim tax As Double

tax = 0

For i = 1 To rates.Rows.Count - 1

tax = tax + Application.Min(income, rates.Cells(i, 1)) * rates.Cells(i, 2)

income = Application.Max(0, income - rates.Cells(i, 1))

Next i

IncomeTax = tax + income * rates.Cells(rates.Rows.Count, 2)

End Function

Subscribe to Posts [Atom]